Magic: the Tragedy

C19 vax safety trials begin, class action, FTX drags down crypto, Colorado Springs shooting, winter drought, suspicious Magic the Gathering auction

Happy Friday, everyone, and welcome back to Rounding the News. My name is Liam Sturgess and I will be your host for today's show, presented by Rounding the Earth.

Before we get started, I want to remind everyone that you can support the show by sending us a Rumble Rant or a tip on Rokfin. Even more importantly, I invite you to join us over on our Locals community, where I have posted the show notes for today's episode along with the links to watch the show live on YouTube, Rumble and Rokfin.

Join the community as a free member or sign up to support us for $5 per month to gain access to Locals-exclusive livestreams, such as the one Mathew and I did yesterday on the topic of Chaos Agents in the medical freedom movement.

Health: Pfizer and Moderna begin clinical trials to investigate safety — after subjecting billions of people to medical experimentation without informed consent

Law: Class action certification hearing in British Columbia less than one month away

Economy: FTX exposure threatens more than just crypto companies, with regulations looming

Environment: Drought conditions continue across North America, sparking concern over winter wheat yields

Culture: Suspicious Magic the Gathering auction result sparks speculation of Hasbro market manipulation

Health

Safety trials begin, two years into historic global medical experiment

Two years into the largest medical experiment in human history, clinical trials are being launched to determine if it was safe to mass-administer mRNA-based injectable products to the global population.

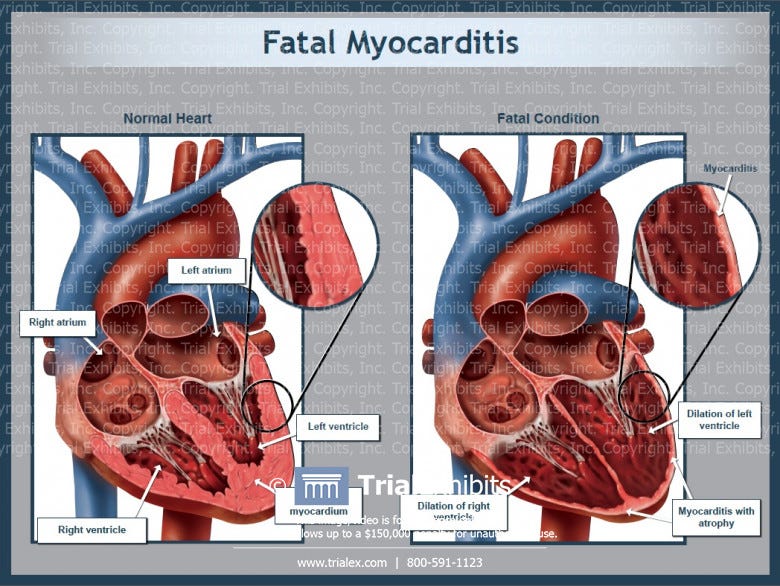

After framing the problem as affecting only “a very small group of people” in the United States, NBC News reports that Pfizer and Moderna are only now starting to look for the true extent of damage in the form of only one adverse event - myocarditis - out of the many severe outcomes documented following injection:1

Moderna has already launched two trials, the most recent in September. Pfizer confirmed that at least one of its trials, which will include up to 500 teens and young adults under age 21, is slated to begin in the next couple of months.

The Food and Drug Administration has required that the drugmakers conduct several studies assessing the potential long-term impacts of myocarditis, as part of its approval of the mRNA Covid vaccines in the U.S. Early findings from the research could be published as early as next year, sources told NBC News.

Some of the trials will follow those who developed the condition for as long as five years, according to the FDA’s approval letters. The trials will be monitoring for myocarditis and subclinical myocarditis, which doesn't cause symptoms.

The FDA declined to comment on Pfizer's and Moderna's studies because they are ongoing, but an agency official said the chance of having myocarditis occur following vaccination is "very low."

Safety of a new pharmaceutical product is traditionally evaluated before its deployment to the general public. Indeed, the interim Phase III clinical trial data published by Pfizer in 2020 showed that the participants who received the shot were sicker than the control arm, suffered more serious adverse events of all kinds, and suffered more deaths.23

This was later re-affirmed by internal trial documents disclosed by court order which detailed how serious adverse events (including vaccine failure and death) were recategorized and hidden.45

Contrary to the quote provided by an FDA official in the NBC article that “the condition does not lead to cardiac-related death,” the prognosis of myocarditis is not bright.6

As pointed out by some Twitter users in response to the news, it is not possible that Pfizer, Moderna, AstraZeneca, Janssen, the Food and Drug Administration, Health Canada, the European Medicines Agency, and the many other pharmaceutical and pseudo-regulatory organizations taking part in the process were unaware of the injury and death caused by these products.

Universities, businesses, governments, and people in positions of authority who convinced, coerced and then forced their students, constituents subordinates and colleagues to receive this irreversible medical procedure without informed consent share responsibility for the illness, injury and death they mandated.

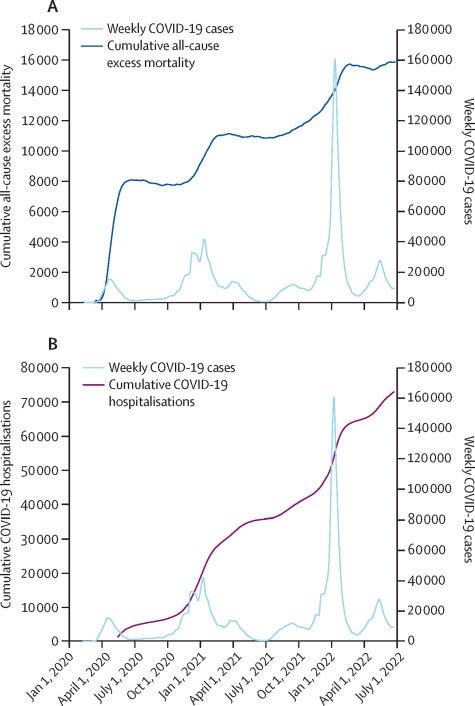

For an illustration, see this handy chart showing the massive non-COVID excess death in Massachusetts timed perfectly with the rollout of the injections.7

The emergency we are facing must not be understated.

Law

Class action lawsuit weeks away from escalating

While COVID-19 injections continue to be administered to the dwindling population unaware of the reality of our situation, good people are fighting in the court of law. The Canadian Society for the Advancement of Science in Public Policy is preparing for their upcoming class action certification hearing, scheduled to begin on December 12, 2022.

In a status update posted to the CSASPP website, Executive Director Kip Warner wrote:8

The world has been waiting nearly two years for it. If we prevail at certification this proceeding formally becomes a class action and may proceed to a forty day trial. That means a single plaintiff is augmented with potentially hundreds of thousands, if not millions, affected by the declaration of an emergency. We also then have the formal tools of discovery made available to us to ask Dr. Henry questions and obtain documents.

The November 9, 2022 update also announced that the hearing would be filmed and made available to the public - the first time in the history of British Columbia. “We believe this is a significant milestone on the road to accountability in respect to the conduct of the defendants,” Warner said.

The hearing will take place in Vancouver, BC, and will be open to the public. CSASPP is crowdfunding their legal efforts - if you want to contribute to their war coffers, you can visit the Donate page on the CSASPP website. As a fellow British Columbian, I can tell you I appreciate it very much!

Economy

FTX continues to pull down crypto with it

Following the whirlwind story last week of the collapse of cryptocurrency exchange FTX, the entire economic ecosystem continues to take hit after hit. More and more companies have revealed they held interest in FTX, meaning they too are under increasing pressure to steady the ship while users pull their assets off of exchanges across the board.

As of November 12, CoinDesk reports that the list of companies signalling FTX-related troubles includes Wintermute, Multicoin Capital, Amber Group, Liquid Meta, CoinShares, Pantera Capital, and Genesis9 - the latter of which officially halted client withdrawals on Wednesday, November 16, sending the price of Bitcoin 3.5% further down.10

Another crypto-based company, BlockFi, suspended most activities on November 11, freezing assets across the board.11

Regulations on the horizon… obviously

The title of a quickly-censored Reddit post says it all: “As expected: Janet Yellen says crypto must be regulated after FTX fiasco.”12 From CBS News:13

Treasury Secretary Janet Yellen has told CBS News that the spectacular collapse of cryptocurrency exchange FTX, which sent shockwaves through the crypto world last week with its bankruptcy filing, should serve as a warning to Americans about investing their money in "extremely risky" financial products traded in a space lacking "appropriate supervision and regulation." …

"We have very strong investor and consumer protection laws for most of our financial markets, but in some ways the crypto space has inadequate regulation."

Yellen said the Biden administration had highlighted "regulatory holes that need to be filled for this to be a space where Americans can feel safe doing business," and blamed the "absence of appropriate supervision and regulation" for the FTX collapse.

In discussions with Mathew Crawford and his community of Bitcoin enthusiasts, the message is clear: take your cryptocurrencies off of exchanges. All of it. Keep it in cold storage where you have full control over it.

I’m not supposed to talk about the Bitcoin group, so pretend I didn’t say anything. It’ll be our little secret.

Environment

Drought conditions remain in the Americas through autumn

For a couple of months now, we’ve been covering the abnormal drought conditions threatening corn and soy harvests in North and South America. Unfortunately, the onset of colder weather has not translated into increased moisture, leaving farmers high and dry once again.

Agricultural Meteorologist Bryce Anderson writes in Progressive Farmer:14

The drought of 2022 shows no letup in many areas of the Great Plains and western Midwest. The 60-day period from mid-September thru mid-November saw precipitation totals which were largely no more than 50% of normal. The result is bone-dry river and stream beds, including a big portion of the Platte River in central Nebraska. The riverbed is so dry that it's turned into an off-roading destination instead of a primary watercourse. Calculated soil moisture ranking in over half of Nebraska is only 1%. …

Responses indicate a great deal of concern that the dry streambeds will continue to be a feature during 2023 as well. "It's probably safe to say the prospects for soil moisture recharge are not good for the Spring growing season," said Michael Moritz, warning coordination meteorologist at the NWS in Hastings. "Any precipitation we manage to receive will be devoured quickly in the short-term, and the long-term prospects could take a handful of wet seasons to recover."

Over on BitChute, ADAPT2030 is warning that winter wheat yields are down across most of the United States, with the possible exception of the Pacific Northwest and other states bordering Western and Central Canada.15 The below chart was generated using data from the United States Department of Agriculture from September 30, 2022, prior to the early onset of freezing temperatures this season.

It’s not just the Americas. Australia is reaching record low temperatures as well, from Tasmania to New South Wales.16

And now, a quick word from our sponsor.

Freedom is always worth celebrating

Indeed, there is never a bad time to raise a glass in honour of our God-given freedom. We live in a time where Presidents deliver Red Sermons of division, while Prime Ministers remain in office for less time than a season of She-Hulk remains on the air.

Don’t sit idly by and hope for change; don’t pine for days where you could have a conversation without triggering your neighbour. Knock on their door today, with a bottle of Blood of Tyrants wine in hand, and toast to each other’s good health.

Buy your bottle at www.BloodofTyrants.wine and save $5 when you use coupon code EARTH at checkout. When you receive it in the mail and pour your first glass, take a picture and tag @RoundEarthClub and @BloodofTyrantsW on Twitter, and we’ll share your picture on an upcoming episode.

Culture

Strange things happening in the world of Magic

It appears that even Magic: the Gathering isn’t immune from the shenanigans playing out in seemingly every sector around the world. It can’t be escaped!

Magic: the Gathering is described as “the first trading card game,” initially launched in 1993 by the Seattle-based company Wizards of the Coast.17 The entire origin story of Magic deserves a deeper dive - if not just to figure out why the Washington School of Public Health, of all academic departments, published a background on the company. For now, we’ll focus on the economics of the new era products as well as the collectibles market.

Among the game’s earliest cards were the highly-popular Power Nine - “rare cards found in the Alpha, Beta, and Unlimited sets” that were so powerful, they were banned virtually across the board.18 The cards are:

Ancestral Recall

Black Lotus

Mox Emerald

Mox Jet

Mox Pearl

Mox Ruby

Mox Sapphire

Timetwister

Time Walk

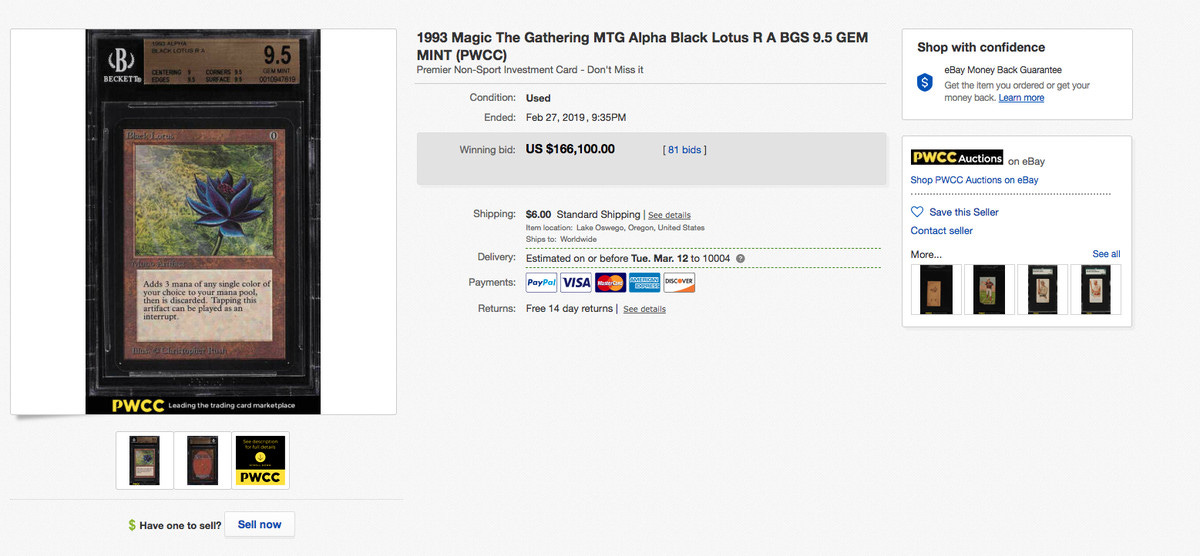

Of course, most people will recognize the Black Lotus for its record-breaking sales prices on the secondary market over the years, including for $166,100 USD in February 2019.19

Meet the Reserved List

As Magic grew in popularity, Wizards of the Coast (henceforth abbreviated to WOTC) issued a number of reprinted sets in order to continue capitalizing while also expanding the game’s reach to new players. This had a number of unintended consequences, primarily the stark devaluation of the earliest cards that had become instant collectors items owing to their “Power-Nine-awesomeness” as well as their scarcity. After some backlash, WOTC issued a promise to never again reprint a list of 572 cards, to “maintain your confidence in the Magic game as a collectible.”20

From MTG Goldfish:21

…if we take a time machine back to 1996 when the list was created, the Magic world looked very different. Magic was a much, much smaller game, rather than the behemoth it is today. There was no certainty that the game would exist the next year, let alone 25 years later. If you look at other similar games, most quickly died off. Magic could easily have experienced the same fate.

In this context—as a new game with an unsure future—we have Chronicles, the first mass reprint set in the game's history. While today, we expect reprints on a yearly or even monthly basis, and much of the player base clamors for more reprints of in-demand staples, at the time, the idea of a high-supply reprint set was completely new. Chronicles took many expensive and in-demand cards from the first years of Magic and didn't just reprint them but reprinted them into the ground, with some cards reprinted in the set falling in price from $50 down to just a couple of dollars. The supply of the set was so high that even today, 25 years later, few of the cards have any value.

The above-listed Power Nine cards are included on the Reserved List. As MTG Goldfish and many others explain, the rules of the list have evolved over time to both acclaim and further backlash.

Hasbro’s great idea

WOTC was acquired by toy giant Hasbro in 1999.22 Though it spent decades "winning big" with the property,23 Wall Street and players of the game alike are starting to call the company out big time for its overprinting of cards and dilution of Magic's inherent value.24

It gets worse from here. 2023 will be Magic’s 30th anniversary, and Hasbro has decided to go big.

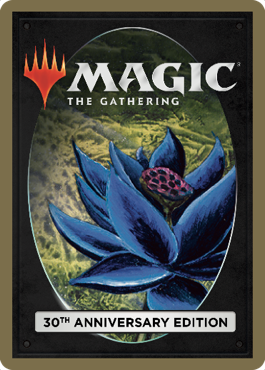

On October 4, 2022, Blake Rasmussen of WOTC announced the release of a special 30th Anniversary Edition set intended “to create an experience for fans new and old that would be worthy of three decades of the original trading card game.”25 Described as “collectible, commemorative, jaw-dropping,” and “mind-blowing,” the set is “a commemorative, collectible, non-tournament-legal product” that is “Inspired by Limited Edition Beta,” the second-ever Magic set printed.

Many of the cards included in this special edition are on the Reserved List, not the least of which is Black Lotus itself.

There are a few considerations to be made here. Keep in mind that there are nuances to WOTC’s reprint policy governing the Reserved List, and as such, various loopholes through which the company can technically avoid going back on their semi-binding promise - while still printing fancy new product to sell to those who want to pay the money. For example, the black border on the face of the card has been swapped for silver to allow for parody cards to be sold for play in an alternate format, outside of legal tournament play.26

Another such loophole is being employed here: the use of a completely different card back. Rasmussen’s own press release quickly gets this out of the way, remarking: “That's the back of the cards. But what you really care about is the front.”

In essence, Wizards has decided to print professional, high-quality “proxies” - in other words, fake cards used instead of playing with the real versions of these high-dollar collectibles.

There’s a robust market for proxies, including services that allow you to print custom editions with your own pictures that can even be used legally in tournament settings. Too bad Hasbro starting shutting these community-driven ventures down, like, yesterday.27

This won’t stop me from creating clever proxies related to the stuff we cover on RTE. It’s way too good an idea to pass up. Here’s a COVID-19 one I found with a quick Presearch:

And this one I just made on a site called MTG.Design.

This is absolutely how I will be spending my next week.

Back to the point…

Hey! I wasn’t off point! In fact, I had to go down that long road to establish some foundational facts to help explain what’s going on in the world of magic today.

If I wanted to get my custom Klaus Schwab card professionally printed, I could do so for $2.00 USD plus a flat $20.00 shipping to Canada. It’s even cheaper for you Americans at just $5 flat shipping, with tracking number. Cool. This is all through a website called Printing Proxies.

With that in mind, let’s ask: how much is Wizards of the Coast asking for their super-awesome 30th Anniversary Edition proxy four-pack? $1,000.

Oh.

Okay.

A quick search on YouTube will reveal that while some people seem excited, most commentators in the space don’t think this is a good idea. In fact, there are some calling this out as nothing more than a cash grab from the executives at the top in order to open the door to further previously-illegal reprints.

Then, there’s this:

In a strange turn of events, an early release copy of one of these proxy cards was suspiciously bid up on eBay to the “winning bid” of $3,050 USD. The card in question, a Mox Pearl, is part of the above-described Power Nine.

On November 12, Riley Hicks at MTG Rocks pointed out that the tournament-illegal reprint was at that point out-valuing its vintage, original counterpart, before the final price was even attained:28

Considering that the 30th Anniversary Edition is, what many players consider to be, proxies, or illegal game pieces that replace a much more expensive alternative, many players did not believe that there would be any value in this product. For a bit of a while, initial sales of the 30th Anniversary Edition packs made it look that way, but a recent auction may squash that outlook completely. …

The current top price for this tournament-illegal card is about $3000 USD. This already surpasses a heavily played legal version of Mox Pearl, which goes for about $2600 in Unlimited. Aside from the novelty, part of the card’s price theoretically comes from the grading of the Mox. A 9.5 grading means that the card is a fraction away from being in perfect condition. Grading like this can do a lot to multiply the potential price of the card, but this is surprising to see regardless.

Of course the condition is important, but in this case, the 30th Anniversary Edition cards are all literally coming off the printing press as we speak. It would be problematic if they weren’t essentially all grading out in the 9.5 range. On the other hand, the value of the vintage cards do spike as the condition improves.

In the video linked above, a YouTube named Rudy who runs a Magic wholesale business called Alpha Investments points out how problematic - and frankly absurd - this auction price is.29 Rudy explained that the seller (named Kid Icarus) had smelled something fishy with the auction and cancelled the sale. A review of the bid history reveals that there were 19 bidders total, two of which had only 1 prior transaction of record on their eBay accounts.30

Why cancel the sale? Because the situation doesn’t make any sense. Beyond the suspicious bidders and bid activity overall, the listing defies what was a clear rejection of the cards’ value in early sales following a limited release at a recent event. The hype was short-lived, but the cards in the ridiculously-expensive packs simply did not cover the cost, while the secondary market wasn't interested.31

Rudy continued, explaining that Kid Icarus chose to wait “until Wizards dumps the rest of the overpriced toilet paper on the market so that we can see what the real value is.”

So, what happened? Given the fact that one of the main bidders was an account with virtually no history of activity on eBay, it seems plausible that this could have been a “guerilla/ninja” attempt to inflate the value of the Mox Pearl reprint on the secondary market in order to get people back onboard with the idea that these cards are actually a product worthy of their hype and luxurious price tag. Then comes the why.

I don’t know if everybody fully understands how big of a deal this launch is, this $1,100 for four packs [after tax and shipping]. … I hope it fails, but I’m afraid because I think it will sell out, and the suits are gonna all give themselves giant hugs. And it’s gonna give them the green light to change everything into a nasty future. …

And a lot of people feel this was part of the… ninja shady marketing. We don’t know. … but man, has it been [a] circling conspiracy theory like crazy.

If Hasbro, through WOTC, can mass-produce a piece of paperboard with virtually no inherent or plausible financial value; as a facsimile of a vintage collectible that does have financial value as established by the open market based on underlying qualities such as scarcity; and the facsimile sells for equal or greater value than the original…

Well, that means one of three things.

The original collectible has no real underlying value;

The original collectible is severely undervalued (as Rudy suggests, though to a lesser degree);

The whole thing means absolutely nothing, and is a blatant, clumsy, gaslighting scam.

Closing thoughts

We can see that the value of the world’s fiat currencies is rapidly plummeting through inflation. Your dollar will continue to be worth less every month,32 while the stock market and real estate plummet as well.3334 Cryptocurrency is under attack through the implosion of FTX (taking the retail industry down with it), and precious metals are under the shadow of institutional "dooming" for the 2023 fiscal year.35

For the first time, I'm wondering if the collectibles market is undergoing a similar process. After all, collectibles are an asset class unto themselves, with varying ease of liquidity and investment security depending on what you’re talking about. Stamps, comic books, rare coins, sneakers, vintage clothes, paintings, antique lamps — some have established marketplaces, others don’t. Bottom line, they are an alternative store of value for some people that may or may not act as a hedge against “Great Reset economics.”

Notice that in the case of fiat currency, stocks, real estate, cryptocurrency, precious metals — even commodities, and oil — are all assets heavily influenced by institution players. Take a look at the things we’ve been discussing and you’ll find the heavy hand of government and big banks that seem to have their hands on every lever, ready to move the markets into the green or the red as suits them. Have we just witnessed an example of how a big corporation like Hasbro can successfully demoralize a community of people who come together around a card game, by diluting both the financial and entertainment value of the product over the course of a couple of years, then topping it off with a cheap, overproduced, overvalued “premium product” out of reach for the average person, yet sure to sell out through possibly contrived means, simultaneously undermining the collectible value of the vintage products and stripping away anything “real” left?

Is this happening with other collectibles? Or am I overthinking this entire subject?

While I’m open to the latter, I can’t help but notice trends and point them out when I see them. Maybe this is an unfortunate coincidence (you know, how every aspect of life is currently under some form of “transition”), or maybe this is yet another example of a system that has gotten too comfortable with “soft people” running things.

Thank you very much for tuning in to this week’s episode of Rounding the News! If you’ve enjoyed the show, please drop us a Rumble Rant or a tip on Rokfin, and before you leave, go sign up as a member of our Locals community at www.RoundingtheEarth.locals.com. You can even snag yourself a free month of premium support using the promo code included on the pinned comment, after which you can keep us going and gain access to behind-the-main-scenes discussions that we’re keeping within our more intimate community.

I have been Liam Sturgess, and you can find me at www.LiamSturgess.com, or on Twitter @TheLiamSturgess!

Lovelace Jr., B. (2022, November 12). Are there long-term myocarditis risks after Covid vaccination? NBC News. https://web.archive.org/web/20221117142046/https://www.nbcnews.com/health/health-news/myocarditis-covid-vaccine-research-long-term-effects-rcna55666

Polack, F. P., Thomas, S. J., Kitchin, N., Absalon, J., Gurtman, A., Lockhart, S., Perez, J. L., Pérez Marc, G., Moreira, E. D., Zerbini, C., Bailey, R., Swanson, K. A., Roychoudhury, S., Koury, K., Li, P., Kalina, W. V., Cooper, D., Frenck, R. W., Hammitt, L. L., & Türeci, Ö. (2020). Safety and Efficacy of the BNT162b2 mRNA Covid-19 Vaccine. New England Journal of Medicine, 383(27), 2603–2615. https://doi.org/10.1056/nejmoa2034577

Canadian Covid Care Alliance. (2021, December 16). The Pfizer Inoculations Do More Harm Than Good. Rumble. https://rumble.com/vqx3kb-the-pfizer-inoculations-do-more-harm-than-good.html

fa_interim_narrative_sensitive. (2022, July 1). Amazon Web Services; Pfizer. https://web.archive.org/web/20221104081616/https://pdata0916.s3.us-east-2.amazonaws.com/pdocs/070122/125742_S1_M5_5351_c4591001-fa-interim-narrative-sensitive.pdf

Nevradakis, M. (2022, July 14). More Deaths, Injuries Revealed in Latest Pfizer Vaccine Trial Document Dump. Children’s Health Defense. https://archive.ph/9TmLQ

Ghanizada, M., Kristensen, S. L., Bundgaard, H., Rossing, K., Sigvardt, F., Madelaire, C., Gislason, G. H., Schou, M., Hansen, M. L., & Gustafsson, F. (2021). Long-term prognosis following hospitalization for acute myocarditis – a matched nationwide cohort study. Scandinavian Cardiovascular Journal, 55(5), 264–269. https://doi.org/10.1080/14017431.2021.1900596

Faust, J. S., Renton, B., Chen, A. J., Du, C., Liang, C., Li, S.-X., Lin, Z., & Krumholz, H. M. (2022). Uncoupling of all-cause excess mortality from COVID-19 cases in a highly vaccinated state. The Lancet Infectious Diseases, 22(10), 1419–1420. https://doi.org/10.1016/s1473-3099(22)00547-3

Warner, K. Status Updates. CSASPP. Retrieved November 17, 2022, from https://www.covidconstitutionalchallengebc.ca/status-updates

Betz, B. (2022, November 9). Who Still Has Exposure to FTX? CoinDesk. https://www.coindesk.com/business/2022/11/09/who-still-has-exposure-to-ftx/

Braun, H., & Yang, J. (2022, November 16). Crypto Market Slides After Genesis Withdrawal Halt, but Big Investors May Hunt for Bargains. CoinDesk. https://archive.ph/OUe65

Update to BlockFi Accounts. (2022, November 11). BlockFi. https://archive.ph/j8eZN

HejdaaNils. (2022, November 14). As expected: Janet Yellen says crypto must be regulated after FTX fiasco. Reddit. https://web.archive.org/web/20221114234347/https://www.reddit.com/r/CryptoCurrency/comments/yvbwpw/as_expected_janet_yellen_says_crypto_must_be/

Reals, T. (2022, November 15). Janet Yellen says FTX collapse shows cryptocurrencies are “risky… even dangerous” investments. CBS News. https://web.archive.org/web/20221118001053/https://www.cbsnews.com/news/ftx-collapse-janet-yellen-crypto-economy-inflation-diesel-shortage-ev-batteries-china/

Anderson, B. (2022, November 17). Drought Maintains Grip on Western Corn Belt. DTN Progressive Farmer. https://web.archive.org/web/20221120212347/https://www.dtnpf.com/agriculture/web/ag/news/article/2022/11/17/drought-maintains-grip-western-corn-2

ADAPT2030. (2022, November 17). Blizzard & Global Wheat Crop Warning. BitChute. https://www.bitchute.com/video/_LeE_E6dS6M/

Dahlstrom, M. (2022, November 16). Four states to be smashed by an unseasonal cold blast this weekend. Yahoo News Australia. https://au.news.yahoo.com/four-states-to-be-smashed-unseasonal-cold-blast-this-weekend-062940175.html

Rothaermel, F. T., Kotha, S., & Moxon, D. (1998, October 19). Wizards of the Coast. University of Washington School of Public Health. https://web.archive.org/web/20060901100217/http://faculty.bschool.washington.edu/skotha/website/cases%20pdf/Wizards%20of%20the%20coast%201.4.pdf

Power Nine. MTG Wiki. Retrieved November 20, 2022, from https://mtg.fandom.com/wiki/Power_Nine

Hall, C. (2019, March 5). Magic: The Gathering’s Black Lotus sells for $166,100 at auction. Polygon. https://web.archive.org/web/20221030163539/http://www.polygon.com/2019/3/5/18251623/magic-the-gathering-black-lotus-auction-price

Official Reprint Policy. (2016, May 4). Magic: The Gathering. https://web.archive.org/web/20221008045304/https://magic.wizards.com/en/articles/archive/official-reprint-policy-2010-03-10

SaffronOlive. (2020, August 24). The Reserved List: Its History, Its Future, and the “Foil Loophole.” MTG Goldfish. https://web.archive.org/web/20220629171013/https://www.mtggoldfish.com/articles/the-reserved-list-its-history-its-future-and-the-foil-loophole

Hasbro gets the Wizard. (1999, September 9). CNN Money. https://web.archive.org/web/20221010185232/https://money.cnn.com/1999/09/09/deals/hasbro/

Hough, J. (2022, November 18). Hasbro Won Big With a Role-Playing Game. Is It Now Diluting the Magic? Barron’s. http://archive.today/2022.11.18-212113/https://www.barrons.com/amp/articles/hasbro-won-big-with-a-role-playing-game-is-it-now-diluting-the-magic-51668805800

Schacknow, P. (2022, November 14). Stocks making the biggest moves in the premarket: Hasbro, Oatly, Advanced Micro Devices and more. CNBC. https://www.cnbc.com/2022/11/14/stocks-making-the-biggest-moves-in-the-premarket-hasbro-oatly-advanced-micro-devices-and-more.html

Rasmussen, B. (2022, October 4). Celebrate 30 Years of Magic: The Gathering with 30th Anniversary Edition. Magic: The Gathering. https://web.archive.org/web/20221120224146/https://magic.wizards.com/en/news/announcements/celebrate-30-years-magic-gathering-30th-anniversary-edition-2022-10-04

Parlock, J. (2021, December 1). Magic The Gathering: What Are Silver-Border And Acorn Cards? TheGamer. https://www.thegamer.com/magic-the-gathering-what-are-silver-border-and-acorn-cards/

I’m sorry. (2022, November 18). Card Conjurer. https://web.archive.org/web/20221120231656/https://www.cardconjurer.com/mtg-proxy-card-editor/creator/

Hicks, R. (2022, November 12). MTG 30th Cards Already Selling for More than the Real Thing. MTG Rocks. https://mtgrocks.com/mtg-30th-cards-already-selling-for-more-than-the-real-thing/

Alpha Investments. (2022, November 16). Magic 30th - MOX PEARL - DOES NOT SELL - SUSPICIOUS ACTIVITY. YouTube.

Bid History. eBay. Retrieved November 21, 2022, from https://www.ebay.ca/bfl/viewbids/364042111732?item=364042111732&rt=nc&_trksid=p2047675.m145235.l2565

Atkin, A. (2022, November 2). MTG’s Most Expensive Product Is Already Selling at a Loss. MTG Rocks. https://mtgrocks.com/mtg-30th-anniversary-edition-reportedly-already-selling-at-a-loss/

Aldrich, J. (2022, November 19). Record-high diesel prices could help drive up inflation. Calgary Sun. https://web.archive.org/web/20221121010211/https://calgarysun.com/business/diesel-shortage-puts-pressure-on-cost-of-living/wcm/5144624d-9ced-41ed-9c56-016f71983ecc

Pan, J. (2022, November 20). “Stocks and bonds are toast”: Robert Kiyosaki warns central banks can’t fix inflation and that “fake” money is forcing state pensions to pivot — here are 3 real assets he likes now. Yahoo Finance. https://finance.yahoo.com/news/stocks-bonds-toast-robert-kiyosaki-130000218.html

Ponciano, J. (2022, October 25). Housing Market Collapse: “Forceful” Slowdown In Home Prices As Warning Signs Become “Eerily Similar” To 2000s Crisis. Forbes. https://www.forbes.com/sites/jonathanponciano/2022/10/25/housing-market-collapse-forceful-slowdown-in-home-prices-as-warning-signs-become-eerily-similar-to-2000s-crisis/

Christensen, N. (2022, November 17). Gold prices to fall 10%, silver prices to fall 17% in 2023 - Metals Focus. Kitco News. https://web.archive.org/web/20221121011114/https://www.kitco.com/news/2022-11-17/Gold-prices-to-fall-10-silver-prices-to-fall-17-in-2023-Metals-Focus.html

It's nice to find lesser seen stories with your curation but the Magic news was a blast from the past trip for me. My son was heavily into Magic from the beginning & there were tournaments in NYC area we would drive to with a crew of his friends making trades & selling cards and building competition decks.. no doubt I've seen a small fortune go through my hands in new packs alone. Fun trivia my avatar that was whittled down over the years by site resizing began its life as a Magic card and if you look really closely you can see the caryatid still there! :~)

https://gatherer.wizards.com/pages/card/Details.aspx?multiverseid=438722

Thank you for doing these Liam, that MTG section was an important highlight worth the length. This move by Hasbro (like many others) seems to be a microcosm of the real problem.

The valuation of assets (of all types) is going a bit cray-cray right now, but I feel like this is an opportunity for the people to dictate our own future. Assets with intrinsic value can/should be what we focus on for determining material wealth, while everything else is completely arbitrary and subjective to the will of the people (rather than a unilateral centralized agency dictating how it is). Essentially, it would be cool to have a free market, but a real one, and not the illusion we currently live under. If we can go in this direction, it could become a legitimate era of enlightenment for the history books.

I like the idea of BitCoin replacing the gold standard, as mathematics is ultimately the controlling force there, though the institutional-level investments going in make me think it's just gonna transfer the wealth gap into a new cryptographically-secured system. But for people like me who are currently on the lower end of the wealth spectrum/poverty line, it doesn't make sense to try to buy in at this point in time. Rather, I find myself wondering, what are the other assets of legitimate value that should be pursued in order to make the most of the crumbling fiat dollar? Infrastructure for growing food/livestock? Tuition towards developing trade/skillsets? Property for providing safety and sanctuary? Arsenal of medicines? Fidget-spinners?